Manual invoice processing is a time-intensive, multi-step process. It starts with sorting and entering details into financial systems, risking errors and consuming a lot of time per invoice. Let’s see the breakdown of how much time each manual invoice processing step takes:

| Process step | Time taken | Details |

|---|---|---|

| Data validation | 1-2 days | Invoices are checked against purchase orders for accuracy. |

| Approval workflows | 2-5 days | Invoices await approval from multiple managers. |

| Discrepancy resolution | 3 days | Any issues are addressed in the exceptions queue. |

| Payment scheduling | 1 day | Invoices are scheduled for payment in batches. |

| Invoice filing | 1-2 day | Invoices are manually filed and records organized. |

| Overall process | Highly inefficient | Bottlenecks at each stage highlight the need for automation. |

The average cost of processing an invoice manually is $15. – DocuClipper

Imagine cutting your invoice processing time and cost in half. Automated invoice processing does just that. Replace repetitive tasks with smart workflows. This helps finance departments to move faster, ensure data accuracy, and focus on driving value. This isn’t just efficiency—it’s a game-changer for the accounts payable process.

This blog explores how automated invoice processing empowers finance teams to improve cash flow and foster stronger vendor partnerships.

What is automated invoice processing?

Automated invoice processing helps digitize, streamline, and simplify the invoicing cycle. Automation software extracts and processes invoice data and manages workflows. Moreover, it integrates with other financial systems to accelerate the entire accounts payable process. Automatic invoicing offers the following advantages:

- Eliminate repetitive tasks

- Reduce errors

- Improve accuracy

- Focus on higher-value activities

Top 10 use cases of Power Automate

Modern businesses face challenges in handling time-consuming mundane tasks. Microsoft Power Automate helps you simply such processes with robotic process automation. Explore top 10 use cases of Power Automate to understand how it can help with your business needs.

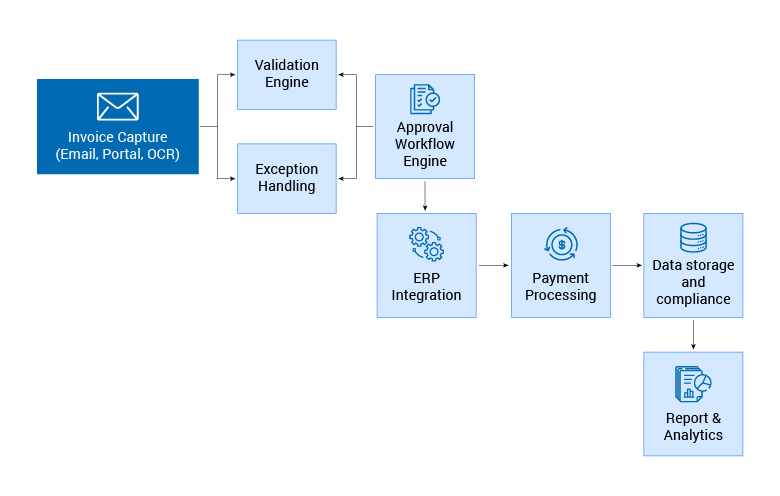

Components of the automated invoice processing

Invoice capture layer

- Input sources: Invoices can be submitted via multiple channels, including email, vendor portals, and document scanning.

- Data extraction: OCR tools extract relevant data fields from scanned invoices and digital documents.

Data validation and enrichment layer

- Validation engine: This component cross-verifies the extracted data with existing databases (such as vendor master or purchase order databases) for accuracy. If there are discrepancies, they are flagged for manual review.

- Exception handling: When the data is missing or incorrect, the invoice is routed to a separate queue for human validation and correction.

Approval workflow engine

- Automated workflow management: Based on pre-configured rules (e.g., invoice amount thresholds, vendor types), invoices are routed through the appropriate approval hierarchy.

- Notifications and approvals: Automated notifications alert approvers. Approvals may take place within ERP or via integration with external systems (like email or a workflow management system).

Integration with accounting/ERP system

- ERP integration: The validated and approved invoice data is transferred into the ERP system for recording and tracking. This ensures that all entries are aligned with the company’s accounting and finance systems.

Payment processing

- Payment gateway: Once approved, the invoice is scheduled for payment based on terms specified in the ERP. Payments may be processed via ACH, bank transfer, or other payment methods.

- Payment confirmation and update: Payment confirmations are sent back to the ERP system and stored as part of the transaction history.

Data storage and compliance

- Database storage: All invoices and processing data are stored in a secure database, with encryption to ensure data integrity.

- Audit and compliance: Logs and audit trails are generated automatically to track each action taken on the invoice, ensuring compliance with financial and regulatory standards.

Reporting and analytics

- Dashboard and reporting: Real-time dashboards and custom reports are generated to provide insights into metrics like processing time, outstanding invoices, and vendor payment history.

Benefits of automated invoice processing

Reduced manual errors

Automated invoice processing eliminates the need for repetitive manual data entry. It helps lower the risk of human errors. With OCR and AI validation, the system accurately captures essential details from invoices. This accuracy prevents costly mistakes, ensures that information remains consistent across records and improves overall data integrity.

Time and cost savings

Automation speeds up every stage of invoice processing, from data capture to approval. It eliminates time-consuming tasks such as manually checking, inputting, and verifying invoices. This efficiency allows finance teams to focus on critical tasks. Automation leads to substantial cost savings on administrative labor.

Enhanced compliance and security

Automated systems ensure that invoices are archived digitally and securely. This digital trail simplifies audit preparation, providing easy access to records.

Improved cash flow management

Automation provides real-time visibility into outstanding invoices and payment timelines. This allows to forecast and plan cash flow better. This visibility enables proactive cash flow management, which can directly impact business liquidity and financial stability.

Avoid delays and late fees

Automation ensures that invoices are processed and approved on schedule. This cuts down the chances of delays that might cause late fees or strain vendor relationships. Automated reminders and workflows help keep approvals on track, leading to payments made on time. Paying promptly saves on penalty fees and builds stronger partnerships with vendors.

Quick ROI and cost savings

Many companies quickly recoup their investment with automated invoice processing. With reduced manual work, errors, and approval delays, businesses can see a return in just a few months. Additionally, automation brings ongoing cost savings as processes become more efficient and labor-intensive tasks are minimized, allowing companies to allocate resources more strategically.

Power Automate: The leading choice for invoice processing automation

Power Automate is the top choice for automating invoice processing, excelling in simplicity and integration. Businesses can quickly create custom workflows, often cutting invoice processing times by 90% over traditional methods. The platform connects with over 500 applications, including popular ERP and financial tools, so data flows accurately and without manual work.

Power Automate also uses AI Builder to bring advanced features like form processing and OCR into each workflow. This OCR scans invoices and pulls key details like vendor names, dates, and line items with high accuracy. This improvement speeds up approvals, reduces rework, and helps close books faster each month.

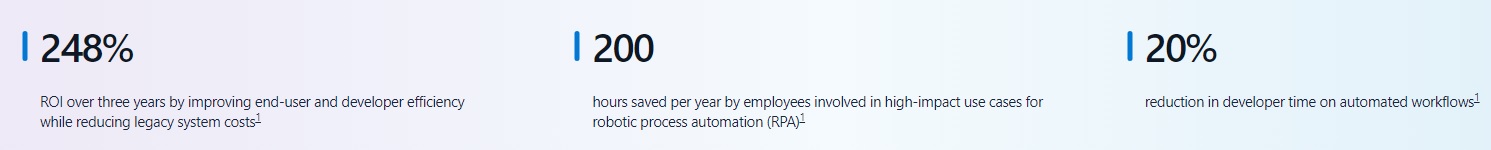

Source: The Total Economic Impact™ Of Microsoft Power Automate by Forrester Research

Unlike other tools, Power Automate integrates directly with Microsoft 365, which is a huge advantage for companies using Microsoft products. With its ability to scale and provide real-time data insights, plus Microsoft’s trusted security, Power Automate is the smart choice for businesses that aim for efficiency, accuracy, and strong ROI in invoice processing.

Suggested: Power Automate vs UiPath: Choosing the right automation tool for your business needs

Automate invoicing to redefine your financial workflows

Automated accounts payable process is more than just a time-saver. It is a game-changer for businesses that aim to streamline operations and improve financial accuracy. It speeds up payments, strengthens vendor relationships, and unlocks substantial cost savings.

Power Automate emerges as the ultimate tool for this transformation, offering seamless integration, powerful AI, and trusted Microsoft 365 compatibility. For organizations ready to elevate their financial workflows, Power Automate is the key to driving efficiency, accuracy, and growth across every transaction.

Softweb Solutions brings extensive expertise in implementing Power Automate to help you achieve these goals. With our tailored Power Automate consulting services, we ensure smooth integration and optimization. Talk to our experts to understand how Power Automate can help you streamline your business operations.